1

1 1

1

Managing your finances should be straightforward and secure. The Commerzbank online login portal provides a streamlined way to access your accounts, manage transactions, and stay in control of your financial world. This guide will walk you through the process, highlighting the platform’s key benefits, security features, and tips for a seamless experience. We will explore why Commerzbank’s digital banking solutions are designed for both convenience and peace of mind.

You will learn about the robust security measures protecting your data, how to navigate the user-friendly interface with ease, and best practices for keeping your account secure.

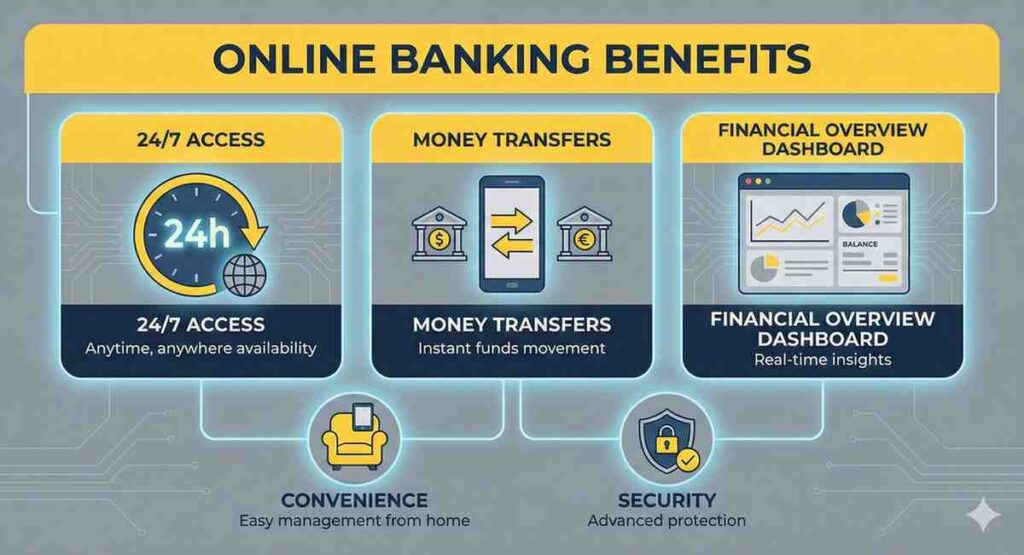

The shift to digital banking offers unparalleled convenience, and Commerzbank has developed a powerful online platform to meet your needs. By using the Commerzbank online login, you unlock a suite of tools designed to simplify financial management. It’s more than just a way to check your balance; it’s a comprehensive hub for your financial life.

The primary benefit is 24/7 access to your accounts from anywhere with an internet connection. Whether you are at home, in the office, or traveling, your bank is always just a few clicks away. This eliminates the need for physical branch visits for routine tasks, saving you valuable time. You can handle transfers, pay bills, and review statements on your schedule.

Total Control: Monitor your account activity in real-time. See incoming payments and outgoing transactions as they happen, giving you a clear and current view of your finances.

Effortless Transactions: Transfer money between your own accounts, send funds to others, or set up standing orders for recurring payments like rent or subscriptions.

Financial Overview: Access digital statements, transaction histories, and an overview of all your Commerzbank products, including savings accounts, loans, and investment portfolios.

Secure Communication: Use the platform’s secure mailbox to communicate directly with the bank, ensuring your personal information remains protected.

Accessing your account for the first time is a simple process. Commerzbank has designed the login procedure to be both secure and user-friendly. Follow these steps to get started.

Before you begin, make sure you have your access data. When you sign up for online banking, Commerzbank provides you with a participant number or user ID and an initial PIN. You will need these to complete your first login. If you have not received these details or have misplaced them, you will need to contact Commerzbank customer service to request new ones.

Open your web browser and go to the official Commerzbank website. It is crucial to always ensure you are on the legitimate site to protect yourself from phishing scams. Look for the padlock icon in the address bar and verify that the URL starts with “https.” The online banking login area is typically prominently displayed on the homepage.

In the designated fields, enter your participant number/user ID and your PIN. For your first login, you may be prompted to change your initial PIN to one of your own choosing. Select a strong, unique PIN that is difficult for others to guess.

Commerzbank uses a two-factor authentication (2FA) process to verify your identity. This usually involves a second step, such as entering a transaction authentication number (TAN) generated by the photoTAN or mobileTAN procedure. This ensures that only you can authorize access to your account.

Security is the cornerstone of online banking. Commerzbank invests heavily in advanced security technologies to protect your financial information and provide a safe digital environment. Understanding these features can give you confidence when using the online platform.

The most critical security layer is two-factor authentication, which Commerzbank implements through its photoTAN and mobileTAN systems.

photoTAN: This method involves using the photoTAN app on your smartphone or a dedicated photoTAN reader. To authorize a login or transaction, you scan a colorful, mosaic-like graphic displayed on your computer screen. The app or device then generates a unique TAN for you to enter, completing the verification. This process links the TAN to the specific transaction, making it highly secure.

mobileTAN: With this method, a TAN is sent directly to your registered mobile number via SMS. You then enter this number to approve an action. While convenient, it’s important to ensure your mobile device is secure.

All data transmitted between your browser and Commerzbank’s servers is protected with strong SSL/TLS encryption. This makes your information unreadable to unauthorized parties. Additionally, the bank’s systems continuously monitor for unusual activity. If a suspicious login attempt or transaction is detected, the system may automatically block it and alert you.

While Commerzbank provides robust security, personal vigilance plays a vital role in keeping your account safe. Adopting good online habits is the best way to protect yourself from fraud.

Your PIN is the first line of defense. Avoid using easily guessable information like your birthday, sequential numbers (12345), or repeated digits (11111). A strong PIN should be a random mix of numbers that is unique to your bank account. Change your PIN regularly as an extra precaution.

Phishing is a common tactic where fraudsters try to trick you into revealing your login details. They often send emails or text messages that look like they are from Commerzbank, directing you to a fake login page.

Never click on links in unsolicited emails or messages.

Always type the Commerzbank URL directly into your browser or use a trusted bookmark.

Remember that Commerzbank will never ask for your PIN or a TAN via email, text message, or phone call.

Ensure the computer or smartphone you use for online banking is protected. Install reputable antivirus and anti-malware software and keep it updated. Apply operating system and browser updates as soon as they are available, as they often contain critical security patches. Avoid using public Wi-Fi networks for banking, as they can be less secure.

The Commerzbank online login is your gateway to modern, flexible, and secure banking. By offering a combination of a user-friendly interface, comprehensive features, and top-tier security, the platform empowers you to manage your finances effectively. Familiarize yourself with the login process and security features to use the service with confidence.

For a safe and efficient banking experience, always follow security best practices. Create strong credentials, stay alert for phishing attempts, and keep your devices protected. With these measures in place, you can fully enjoy the convenience of managing your finances anytime, anywhere.

Furthermore read our lates articles visit our site trezx.com.